Cost price squeeze blow for the primary dairy industry

The low producer price for unprocessed milk together with the price increases of yellow maize and soya beans in October reduced the milk : feed price ratio to 1,15:1. The September 2019 derived feed price compared to September 2018 is 23% higher. At the milk : feed price ratio level, the majority of dairy farmers will not break even and will have to fund their operations from equity or borrowings, if available. The double dip in the above ratio that farmers experienced in the first ten months of 2019 will have a prolonged effect on supply in the coming months and in the next season.

Supply side

Unprocessed milk production for October 2019 is estimated at 332 million litres, 1,7% more than in October 2018. The comparative growth percentage for October 2018 was 3,7% and 3,5% for October 2017. Cumulative unprocessed milk production for 2019, inclusive of October is 2 705 million litres registering a growth of only 0,53%. Compared over the same period in 2018 the growth was 5,8%.

The primary industry is clearly haemorrhaging due to the cost price squeeze, which is exacerbated by the unfavourable climatic and economic conditions. It seems that the overhang of dairy stocks that was created by the strong unprocessed milk production growth of 4,8% in 2018 adequately buffered the current low growth in production to still meet demand.

If the level of producer prices is a function of the demand from the secondary industry, it seems that supply and stock levels are adequate since some processors appear to stand aloof of the extent of the cost price squeeze in the primary industry. The MPO is still receiving information from farmers whose milk buyers are reducing producer prices or simply replacing current suppliers with unprocessed milk suppliers from other regions.

Dairy farmers need to plan to grow unprocessed milk production with less than 2% per year in order to achieve a progressive producer price scenario. The magnitude of the decrease in producer prices when slightly higher growth is registered is simply too devastating.

Dairy imports for the first nine months of 2019 is down compared to 2018. It is evident when compared to 2015, 2017, and 2018 that dairy imports are at a much lower level. The September 2019 cumulative import figure is 11% less than the September 2018 cumulative figure and 29% less than the September 2017 cumulative figure.

Demand side

The September year-on-year sales volumes and price changes are indicating that demand is more subdued than a year ago. Sales volumes are clearly under pressure with six of the nine products registering a negative growth, one product a small increase in volumes sold with the remaining two (yoghurt and maas) doing well. However, yoghurt and maas are not big volume players. Four product prices increased with less than inflation, two marginally more than inflation, while three experienced more aggressive increases.

UHT milk that has been growing market share aggressively over the past three years with low price increases seems to be losing steam. Volumes sold in September 2019 is 9,3% lower than in September 2018. This will have a direct negative impact on the demand for unprocessed milk. Consumer spending has been under pressure for some time and will remain under pressure, which will influence dairy demand negatively.

The UHT price increase over the 24 month period from September 2017 to September 2019 was 9,6% and over the 18 month period from March 2018 to September 2019 was 9,5%. The low price increases enabled UHT sales volumes to grow substantially, but the low price increases set the stage for the product price to catchup at some stage, which appears to be happening now.

International dairy product prices

In October SMP prices strengthened with a further 8% in Dollar terms, full cream milk powder with 2%, butter stayed the same while cheddar prices decreased with 6%. In Rand terms, price behaviour in October 2019 was similar due to the R/$ exchange rate being stable between September and October.

Trends in the production of unprocessed milk in the major dairy exporting countries

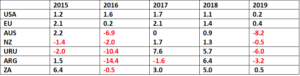

Changes (%) in cumulative unprocessed milk production in the major dairy exporting countries and South Africa 2015–2019 (2019 only first nine months). South Africa’s first ten months, last two preliminary.

Milk production at farm level is down for all the major exporting countries. This provides illumination on the strong increases in international dairy product prices all round for the first 10 months of 2019 and the current nervousness on the Global Dairy Trade Index.

Published on Friday, 29th November 2019 - 05:15

Recent Posts

disclaimer