MPO POINTER 1/4 JANUARY 2021

BACKGROUND

The MPO regards it as imperative to stick to one data source, which is regarded by the industry as official and authoritative, regarding macro price levels and trends in dairy prices (primary, secondary, and retail).

The divergent trend that has been observed since the beginning of 2018 in the price of unprocessed milk (farmer price) and dairy products (both secondary and tertiary) is as plain as daylight and should not be obscured by statistical noise that is being used as a red herring. Public statements containing statistical noise are hindering role players in the value chain in their attempts to establish equitable margin sharing within the value chain. This could lead to one-sided deductive reasoning, resulting in incorrect revelations.

Statistics South Africa is the official and authoritative source regarding datasets for economic indicators, such as the calculated indices for producer prices (primary and secondary), consumer prices (retail prices), and the South African gross domestic product. Statistics South Africa provides data on a national basis using a very specific methodology and repetitive process. Indices calculated on this basis are instrumental in indicating huge swings in prices over time, while taking cognisance of possible time lags and statistical outliers. In the case of the producer price index (PPI) for dairy products (fresh milk, UHT processed milk, yoghurt, and cheddar cheese) and the consumer price index (CPI) for milk, cheese, and eggs, it is quite understandable that these indices do not include all dairy products and that the time series should be used in that regard.

Therefore, it stands to reason that if different data series gradually diverge over time this could be due to market changes that could necessitate changes in the product basket (mix) or changes to weight allocations within the product basket. In the case of the PPI for unprocessed milk and dairy products (fresh milk, UHT processed milk, yoghurt, and cheddar cheese) and the CPI for milk, cheese, and eggs, price movements have been radical. This phenomenon suggests that price movements cannot be explained away as a result of an unrepresentative product basket, but rather that the key is the price levels that are responsible for trends in the relevant indices.

PRICE TRENDS IN UNPROCESSED MILK (FARMER PRICE), PROCESSOR PRICES, AND CONSUMER PRICES (RETAIL PRICES) FOR DAIRY PRODUCTS

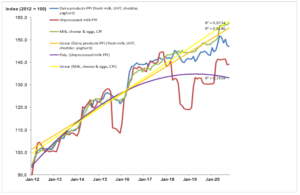

It is evident from the graph below that the price indices track in a narrow band, reflecting a measure of homogenous behaviour in the different indices up to March 2018. There was a drastic downward movement in the farmer price of unprocessed milk from August 2015 to February 2016 (lasting seven months) due to a huge increase in the production of unprocessed milk during 2015, leading to reduced farmer prices. Once market balance returned, the indices happily track once again from March 2016 to March 2018. There was another drastic downward movement in the farmer price for unprocessed milk from April 2018 onwards due to another huge increase in the production of unprocessed milk during 2018, leading to reduced farmer prices. During this movement, farmer prices dropped to the same level as in October 2014, recovering partly in May 2019, to drop again in September 2019, resulting in a double drop followed by a partial recovery in May 2020, although they never adequately re-joined the other two indices.

The significance of the above chronological flow of unprocessed milk prices is as follows:

- The severity and depth of the first drop in 2018 and the lack of upward momentum since then cannot be ignored. Prices seem to be sticky at lower levels with supply (production of unprocessed milk) being stubbornly maintained. This phenomenon is due to the structural change that has occurred in the primary dairy industry over the past decade.

- From March 2016 to March 2018, the indices tracked well enough and nothing changed from March 2018 to the present that suggests that the current basket of products in the different indices is no longer representative of market activity.

- The fact staring one in the face is that the CPI for milk, cheese, and eggs is at a record high, while the October 2020 price for unprocessed milk is at the same level as in December 2017. The prices in question are at the macro level as supplied by Statistics South Africa. These prices are the aggregate of the different samples.

Figure 1 PPI indices of unprocessed milk and dairy products and the CPI of milk, cheese, and eggs with regression model fits, Jan 2012–Oct 2020 (Source: Stats SA).

The widening gap between what a dairy farmer receives and what consumers pay for dairy products is only one of the curtain-raisers in the dairy value chain concert. The level of volatility at farmer price level is illustrated by using regression models to determine a trend. R-squared is a measure of how well a model fits the data. It can be interpreted as the proportion of variance explained by the model. It is a number between 0 and 1 (0 ≤ R² ≤ 1). The closer its value is to 1, the more variability the model explains.

The linear regression is not a good fit for determining a trend in producer prices of unprocessed milk (farmer price), although it provides a good fit for the other two indices, namely dairy product prices (R² = 0,92) and retail prices (R² = 0,97) for milk, cheese, and eggs. The basic linear regression indicates the trends in play to help with planning for the two role players downstream from the dairy farmer. While testing other regressions (exponential, logarithmic, polynomial, and to the power of), the polynomial regression provided the best fit for the producer price of unprocessed milk (R² = 0,75). The trend has actually turned south from June 2019 onwards due to producer prices having dropped sharply from April 2018, never to fully recover. With producer prices behaving as they did over the past couple of years, business planning at primary level (farm level) is difficult.

It is important to note that producer prices are not only influenced by market factors, but could also be influenced by the specific circumstances at a processor or retailer that could overshadow market forces.

“THE MARKET IS LIKE THE WIND – YOU CANNOT SEE IT, BUT YOU CAN FEEL IT” – ANONYMOUS

The market is a broad term that covers buyers, sellers, and sentiment. It is the premise of the MPO that we need the farmgate milk price to be discovered in this very market in a transparent and market-related manner. We believe that evidence of concentrated market power in the value chain exists and that it is a threat to the dairy farmer, black economic empowerment in the dairy industry, dairy farm workers, and supply chain role players upstream. We regard the concentrated market power as contributing to imperfect market competition, which is further distorted by the information asymmetry where downstream role players in the value chain have more and better information than an individual farmer. This creates an imbalance of power in transactions where the farmer has to accept the transaction as offered.

Public statements indicating that the bargaining power between a dairy farmer and a milk processor shifts depending on the availability of unprocessed milk are untrue. Milk producers are quintessential price takers. The very nature of dairy farming and the characteristics of milk are the result of a very exposed producer. The extent to which dairy farmers move from one buyer to a different buyer is not due to the farmer’s bargaining power, but merely due to the farmer being offered a better price by a different milk processor. This has nothing to do with farmer bargaining power.

To infuse the notion of dairy farmer bargaining power as a function of the availability of unprocessed milk is simplifying a complex set of factors that a dairy farmer has to consider when offered a better price by a different milk buyer: is the milk buyer in it for the long haul, how will moving away from one milk buyer to a new milk buyer influence the milk pickup route, will the move result in the other milk buyer (assuming there are two) no longer being viable and resulting in there being only one remaining milk buyer in the area, how creditworthy is the new milk buyer, and what is the contractual liability with the current milk buyer? It should be mentioned that often only one milk buyer exists in an area, a fact which speaks for itself.

PRICE DISCOVERY VERSUS PRICE DETERMINATION

We need to differentiate between price discovery and price determination. In short, price determination is where the price is set by someone, with sellers willing to accept the price offered. In a market where power is concentrated, this could be done by one of the role players, where the others use that price as a basis.

In contrast to this, price discovery is the process of finding the price through the interaction between buyers and sellers. It allows the forces of supply and demand to arrive at a transaction price and involves a central market where buyers and sellers meet. Typically, this is a commodity exchange or auction. In a transparent market, the price discovery process involves buyers and sellers arriving at a transaction price for a specific item or product at a given time. Price discovery is the summation of the total market’s sentiment at a point in time – a multifaceted aggregate view of the future. Price discovery does not exist in the primary dairy industry.

FORCES BEHIND THE ALLOCATION OF RESOURCES

In a market economy, the forces of supply and demand underlie the allocation of resources in the most efficient way. When supply and demand are equal, the economy is said to be in equilibrium. At that equilibrium price, the suppliers or producers are selling all the products that they have produced and processors or consumers are receiving all the goods that they demand. It is, therefore, imperative for the price to provide the correct signal to the role players in the dairy value chain to ensure the correct allocation of resources.

However, in the real marketplace, equilibrium can only be reached in theory, because the prices of goods and services are constantly changing in relation to supply and demand. One can argue that perfect competition and a pure monopoly are imaginary, but monopolistic competition (imperfect competition) is real. Imperfect competition is part of the real world and lies in between pure competition and pure monopoly – the two extremes. Thus, we need to accept that we will operate in imperfect markets and that we need to employ measures and tactics to lessen the impact of imperfect competition. Sweeping public statements that the law of supply and demand will sort things out are therefore incorrect, since there are limitations to what a market with imperfect competition can do.

The ability to objectively evaluate market performance and to acknowledge shortcomings that are present in many market-oriented economies indicates maturity and constructive engagement. Public statements to the contrary are short-sighted. This very engagement indicates to consumers that role players are actively refining the variables and information dynamics regarding price formation in the value chain to ensure value for money and consequentially improve the image of dairy products in the market.

Bertus van Heerden, chief economist, Milk Producers’ Organisation (MPO)

Published on Wednesday, 6th January 2021 - 07:54

Recent Posts

disclaimer