MPO Pointer 2/2020 (31 January 2020)

The graph below confirms how ruthless the South African milk producer is being milked. At the same time, the South African consumer is also stretched by the margins realised post farmgate. The question is whether this concerning trend is driven by pressure from share holders on retailers and processors to realise maximum dividends, or do major inefficiencies exist downstream in the value chain. A third alternative is that the downstream sector of the value chain is not concerned about the supply of raw milk, since shortages can be supplemented by imports.

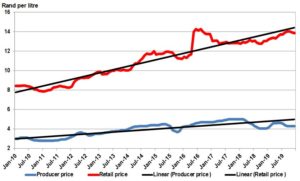

Source: Statistics SA (2ℓ container, full cream fresh milk) and the MPO

The margin between producer price and retail price is increasing steadily at a tempo that clearly illustrates how the concentration in the market is jeopardising the primary industry and is borderline to exploiting the consumer. The difference between producer price and retail price was R5,44 (R8,44 minus R3,00) in January 2010 and R9,56 (R13,86 minus R4,30) in December 2019. The margin grew by 76%, which points to either significant profits realised by processors and/or retailers, or gross inefficiencies at the expense of dairy farmers and consumers.

The market power in the dairy industry is in the hands of large retailers and processors. The concentrated market power jeopardises the primary industry, poses a threat to job opportunities in the entire value chain, and impacts negatively on the ability of the primary industry to obtain financing. It, furthermore, increases the barriers to entry for developing black dairy farmers. The asymmetry of information in the industry resulting in the role players downstream in the value chain having more and better information at their disposal increases the imbalance in the market. This leads to an imbalance in the distribution of power within a transaction resulting in the farmer having to accept a transaction as offered.

The MPO is liaising with the National Agricultural Marketing Council to facilitate discussions with the Competition Commission. Discussions are taking place with MPO members regarding the positioning of the industry.

Bertus van Heerden, chief economist, Milk Producers’ Organisation (MPO)

Published on Friday, 31st January 2020 - 15:53

Recent Posts

disclaimer